Solar energy stocks are one of the most sought-after renewable energy sectors for investors. Using this green energy is beneficial for lowering a company’s carbon footprint and essential for benefiting the economy and environment. Solar energy can generate more energy and produce sustainably fewer emissions than its other power source counterparts.

The constant stress on adopting green alternatives to conserve energy and fight global warming has prompted investors to accelerate its stock market. Although the impact of hydrocarbon-based energies is slow, their utilization rate would project doom shortly without an efficient alternative.

This is where solar energy stocks play a crucial role in getting traders and investors maximum exposure to the solar energy industry. Read on to discover more about solar investments.

Benefits of Using Solar Energy

Cost-Efficiency

Using residential solar energy systems removes the need to use electricity from the grid. The offset of electricity expenditure makes the system’s maintenance and production costs negligible. The only cost associated with solar energy is its component manufacturing and installations.

Minimal Loss of Energy

Energy loss during transportation and distribution of energy increases with distance. While energy loss is not huge, it can affect the performance of the installation if the area has a high population.

But if you have an individual installation of solar panels on the rooftops, energy distribution can be minimized immensely, and the performance would be efficient.

Simple Installation Techniques

Nowadays, solar panel modules are manufactured with system flexibility and consumer ease in mind, which means they can be installed almost everywhere where the sun shines most. Moreover, the panels can come in both vertical and horizontal spaces. So, any small-scale solar project has the added advantage of expandability if energy requirements increase.

The remote locations can use electricity whenever required without fearing a power outage. In addition, the improved security of solar energy systems also contributes to making the grid more secure.

Things to Know About Solar Energy Industry

Since the global population and energy utilization are increasing, the demand for energy production is also high. However, various sectors have shown reluctance to invest in fossil fuel power sources that can damage the environment and contribute to global warming and climate change.

This reluctance is the most prominent reason investors are interested in renewable energy, such as solar, tidal, and hydroelectric energy.

The growth rate of the solar industry has risen at an express speed within the past decade. A 2018 solar energy stock market analysis has shown that it has increased by 150%. The financial market data also reveals that the industry expects to grow at an annual rate of 14.9% by 2023, with an estimated market growth of $286.3 billion.

However, the market growth rate might fluctuate due to the supply of materials and consumers’ demand. For example, when consumers work on large-scale projects, they invest in solar energy companies, increasing their revenue. But when there is less demand in the market, or cheaper supply materials come into the mainstream market, it becomes hard for the companies to keep their production value consistent.

Although there is much uncertainty, the solar energy market has shown substantial growth of about 7% in 2019.

Different Types of Solar Stock Investments

Solar Panel Manufacturer Companies

These are part of the best solar stocks that produce components for every solar panel, involving inverters, solar batteries, and advanced programmed software.

Solar Panel Installers

These are the second major part of the solar stock, which sells solar panels and other associative components directly to the consumers.

Solar Financing Companies

They are the companies that offer financial freedom to the companies working on solar projects. Moreover, they avail loans for the consumers to spend on solar installation.

Methods to Take a Stand on Solar Stocks

- Investing in solar companies with commencing a share dealing account

- Open a trading account to trade solar company shares

If you are still not ready to trade on the above markets, you can start your solar trading strategy within a secure investing ecosystem by opening an IG demo account.

Investing Process in Solar Stocks

While investing in solar stock, you will have to buy shares in a renewable energy company directly, and you can make a profit if your share increases in price. Later, you can sell the energy stocks. Moreover, as you buy a share in a solar company, you gain shareholder rights, including dividend payments and voting rights.

Trade-In Solar Stocks

Investors can postulate the price of solar stocks by utilizing the ongoing bets’ derivative products, market data, sales, etc. While trading solar stocks, acquiring or owning any underlying shares is not wise, which would not profit you any shareholder rights.

However, you can benefit from the price movements coming from both directions. You can be short- or long-time investors with numerous investing opportunities.

While betting, you must place a bet in one direction—i.e., where the solar stock market price is heading. Therefore, your profit and loss factor would be determined by whether the market price is moving in your chosen direction.

Major Solar Energy Stocks

There are many prominent solar energy stocks [1] available in the market where you can make a few investments to take optimum advantage of the solar energy market cap. Some of the major solar energy stocks with a large number of investors are:

- Powershares WilderHill Clean Energy

- SunPower Corporation (Spwr stock)

- First Solar (Fslr Stock)

- Enphase Energy Inc. (Enph Stock)

- Suntech Power Holding Ltd.

- Solar Enertech Corp

- LDK Solar

- Solarfun

- Miasole

- Nano Solar

- JA Solar

- China Sunergy

Challenges for Solar Stocks

According to various stock critics, investing in solar stocks is just like investing in high-tech stocks, and this hype is exaggerated. The primary reason for such a feeling is associated with solar quotes. From the critics’ point of view, it’s pretty challenging to develop economic and viable solar energy. In addition, the costs of investing in solar stocks are incredibly high, so it can be challenging to make the investment profitable.

Secondly, the fairness of these stock prices is also complicated as the stock value falls about 50% for a one-time investment since the stock quotes are high and volatile. Investors can buy a share in high-growth companies, so they don’t need to risk their money funding risky stocks.

Stock investments should not be about a money-grabbing mindset. Instead, intelligent investment in the renewable energy stock market should be about strategies.

Positive Impacts on Solar Energy Stock

Although there are many challenges, solar stock investment is still a very profitable stock market in the global economy. Many solar companies have billions of solar investors to make positive revenue growth. These solar power companies have much support, such as intelligent energy management strategies, extreme sunshine sources, and governmental assistance.

Today, solar energy stock has leaped high, and its interest rates are falling. Therefore, solar energy projects have become economy-friendly and attract developers worldwide.

Enphase energy designs are also an effective energy solution. These emphasize energy designs are software-based home energy systems that work as microinverters installed directly under the solar modules. Enphase energy works by converting the solar energy-generated DC power to AC power.

Reasons to Invest In Solar Energy Stock

Affordable Operation

Solar energy production is not cheap compared to its other counterpart, renewable energy. Therefore, even various governments have started offering subsidies by breaking tax credits. Moreover, the investor gets utility subsidies, and banks offer low-interest loans to solar stock investors.

More Growth Opportunities

Solar stock investment can surely lower fossil fuels, which damage the environment. However, the renewable energy industry can offer much without limit, especially solar energy. A recent report also says that the Biden administration has said that the US should make 50% of its electric supply from solar energy to change its climate change strategy substantially.

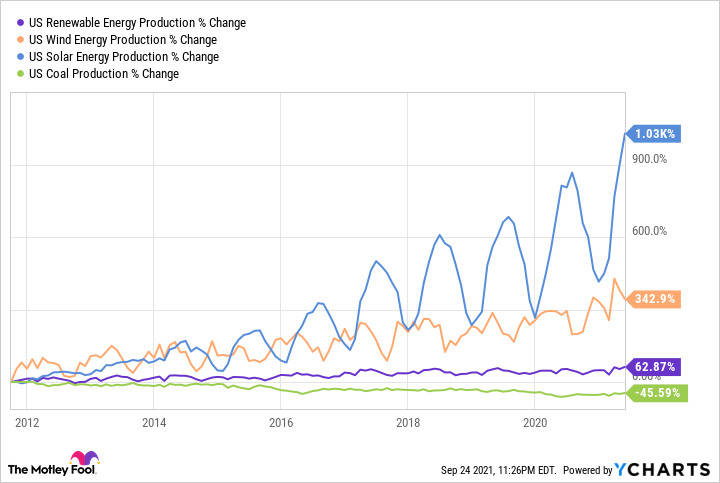

You can now see from the above line chart that the US now utilizes more of its renewable energy from solar energy rather than any hydrocarbon fuels.

Technological Advancement

The implementation of advanced technology can be beneficial for renewable energy, and solar energy solutions are the perfect example of it. Market studies say that the cost of solar panels has significantly reduced by up to 65% within the last decade. Similarly, the cost of other renewable energy sources is decreasing due to frequent technological adaptation and making it more competitive than fossil fuels.

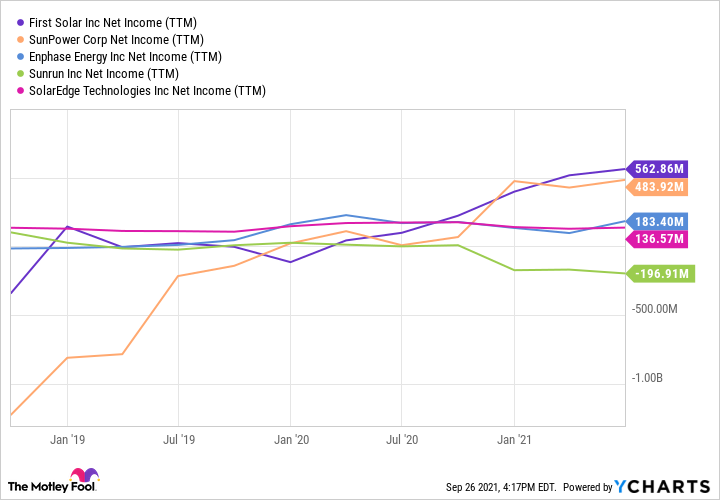

Economic Improvement

Many novice non-hydrocarbon companies have struggled to make money consistently in the past decade. However, this situation has been changing as more and more companies mature. Many prominent solar energy stocks such as Fslr, ENPH, Spwr, and many more have profitable outcomes with many investors as they work with large finance solar projects.

Moreover, many of their financing partners have also developed rather than how they were a few years ago. They made their growth via organic, renewable energy projects and acquisitions.

Compliance with ESG

Every savvy investor looks at the environmental, social, and governance factors while making investment considerations. There are still investors who have a share in fossil fuel energy. However, after shelling off those shares, solar energy storage can benefit them with the compliance of green ESG factors.

Final Words

From the above discussion, it can be clearly illustrated that renewable energy stocks are growing faster than hydrocarbon energy stocks. As technological improvement is happening, stock investors are also growing. So, you can expect that solar energy stock will be the hottest market share in the next decade.